This Week in DeFi: Usual Changes Redemption, Sonic TVL Booming, Boyco Vaults

Podcast: Youtube | Spotify | Apple

This Week had less major launches, but more DeFi drama.

Usual Changes Redemption Value to 0.87

The big news over the weekend was Usual Money changing the redemption value of USD0++ from 1 USD0 to 0.87. USD0++ is a 4 year bond and for people who read the docs carefully, this wasn't totally surprising, but many people did not. In addition, Usual's own messaging and the marketing around USD0++ was unclear. In fact Morpho markets even hardcoded USD0++ value to 1.

Users felt rugged, and rightfully so. USD0++ price dropped to 0.91 over the weekend - if you bought at $1 you were down bad.

Usual soon came out with a new article announcing an early redemption process: users could forfeit their USUAL yield up to 6 months to redeem USD0++ 1:1 , with the details to be announced soon.

Launches

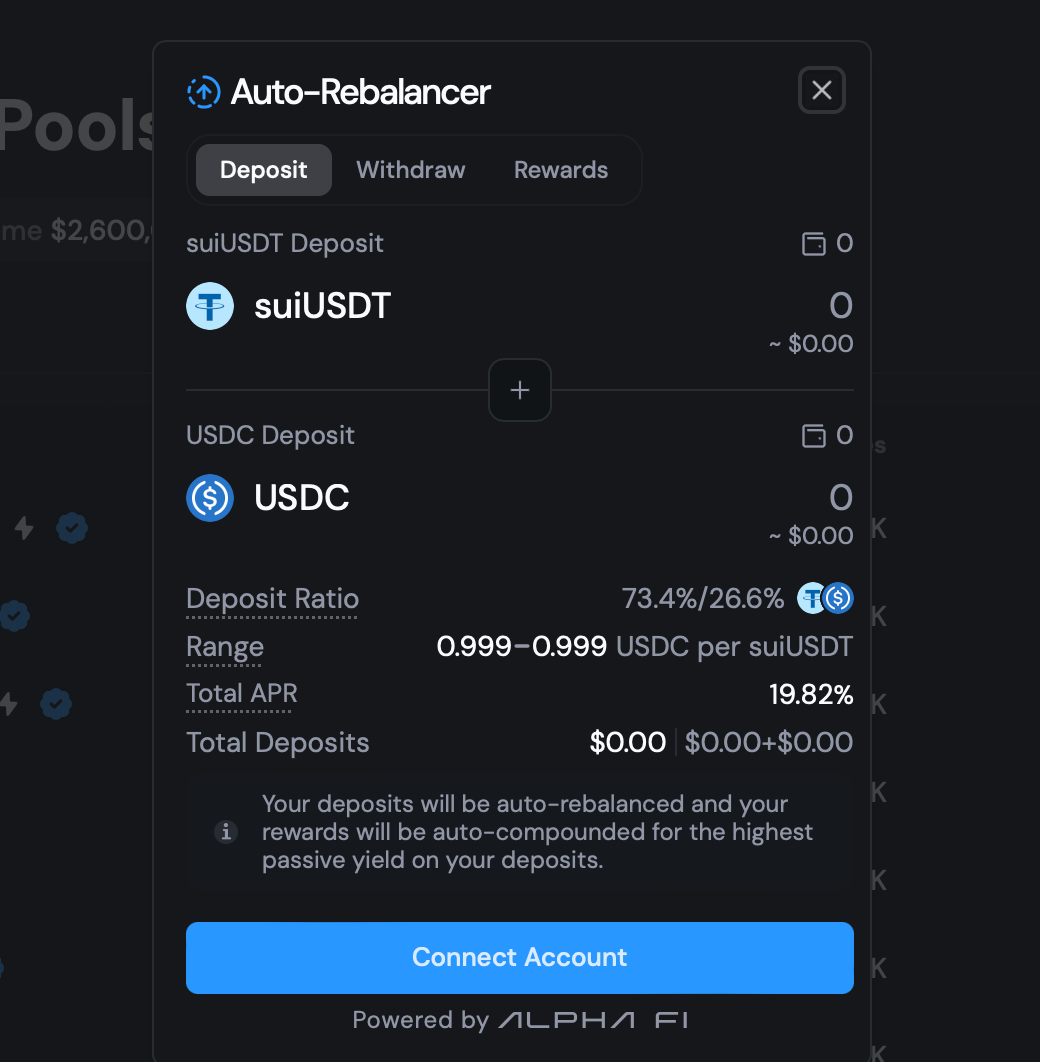

BlueFin, a SUI Dex, introduced their Auto-rebalancer - an auto-LP management tool. I've always hated how Uni v3 launched concentrated liquidity without a passive management tool, so this was cool to see.

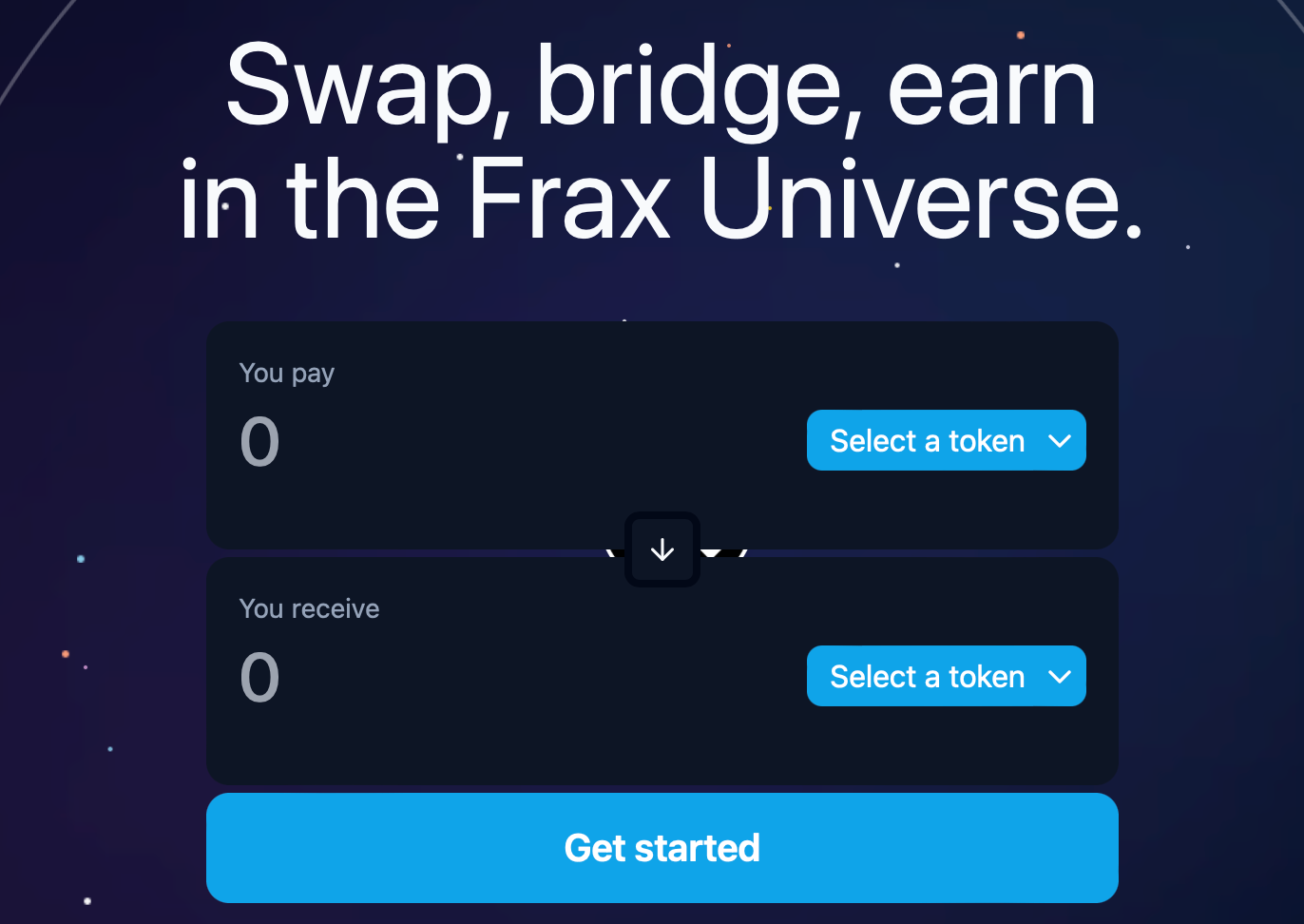

Frax launched an actually nice UI. Frax is an OG stablecoin project thats actually pretty solid, but has always had a very inaccessible, hard to use UI, so this was cool to see. Besides swapping assets, you can also bridge to and from Fraxtal easily, and stake frax to earn 11% APR.

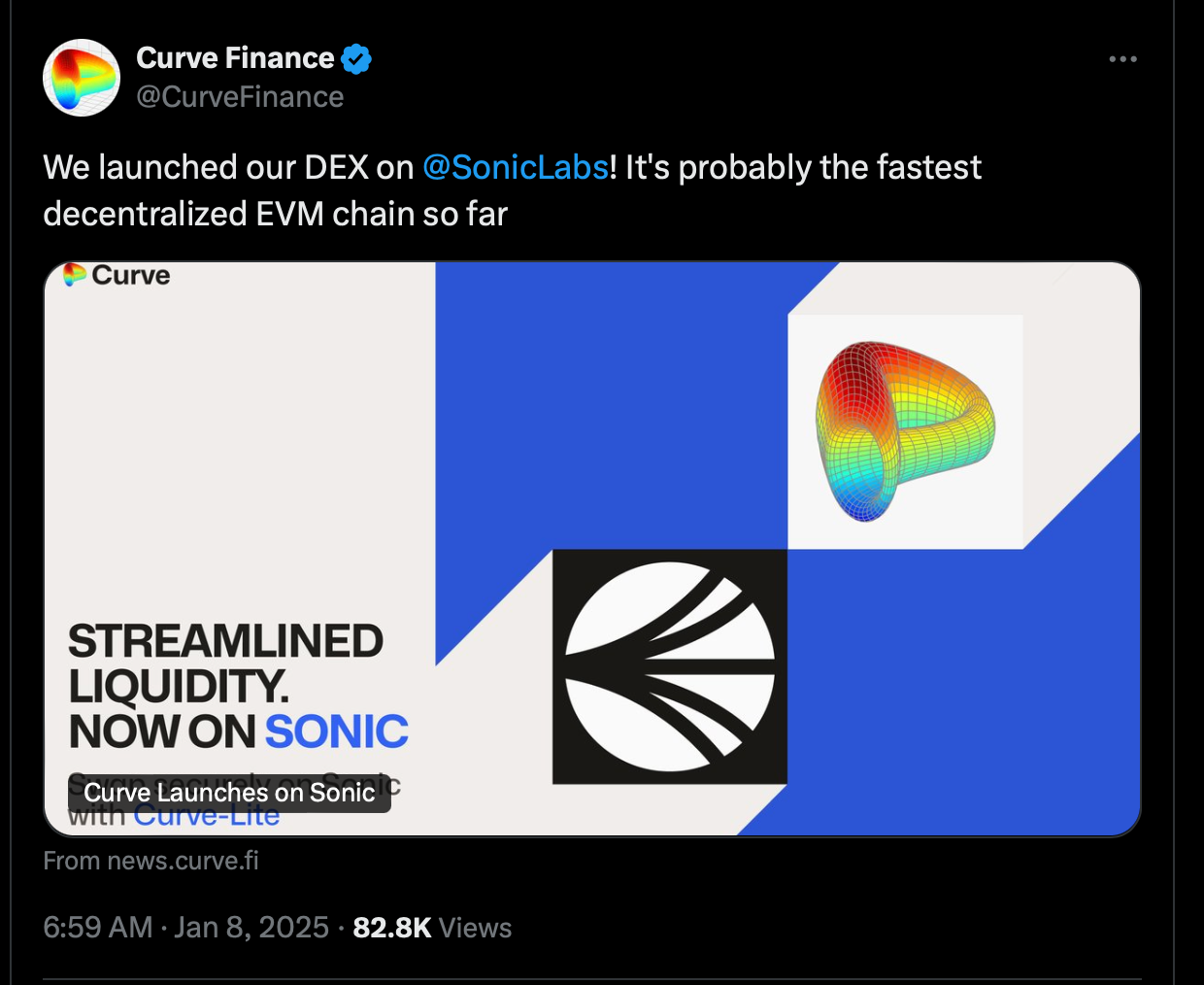

Sonic Booming

Sonic has seen a lot of protocol deployments recently, and TVL is booming. This is no doubt in part from the incentive programs Sonic has for both users and developers. Compared to other incentive programs I've noticed that Sonic has attracted what seems to be higher quality protocols. It may be worth taking a look at Sonic, even if its just to farm some $S.

Stablecoins Integrating USCC

Another news last week was that Superstate Launched $USCC, a carry trade fund. This is similar to Ethena. As Frax already has treasuries, integrating USCC allows them to earn yield across both bullish and market conditions. This is quite similar to what Ethena is doing by integrating USTB, and I think it's quite smart.

DeFi TVL drew down a lot in 2022 because real world yields were higher. Integrating Treasuries allows stablecoins in DeFi to counteract that outflow when rates are high, while integrating basis trades like Ethena and USCC allows DeFi to suck in TVL when conditions are bullish.

Solayer SVM

Solayer unveiled plans to create an SVM. The thesis is that Solana is already reaching its limits and hardware acceleration is needed to make it faster. But Solayer seems to not be an upgrade of Solana itself as much as its own blockchain, tightly integrated with Solana.

You won't need to change wallets or even chainIDs, and Solayer will have "native bridging". To me this is like the 2025 version of Matic but for Solana. I actually find it quite cool.

Solayer is an actually decent project that offers good restaking yield on SOL. May be worth using.

Boyco Vaults

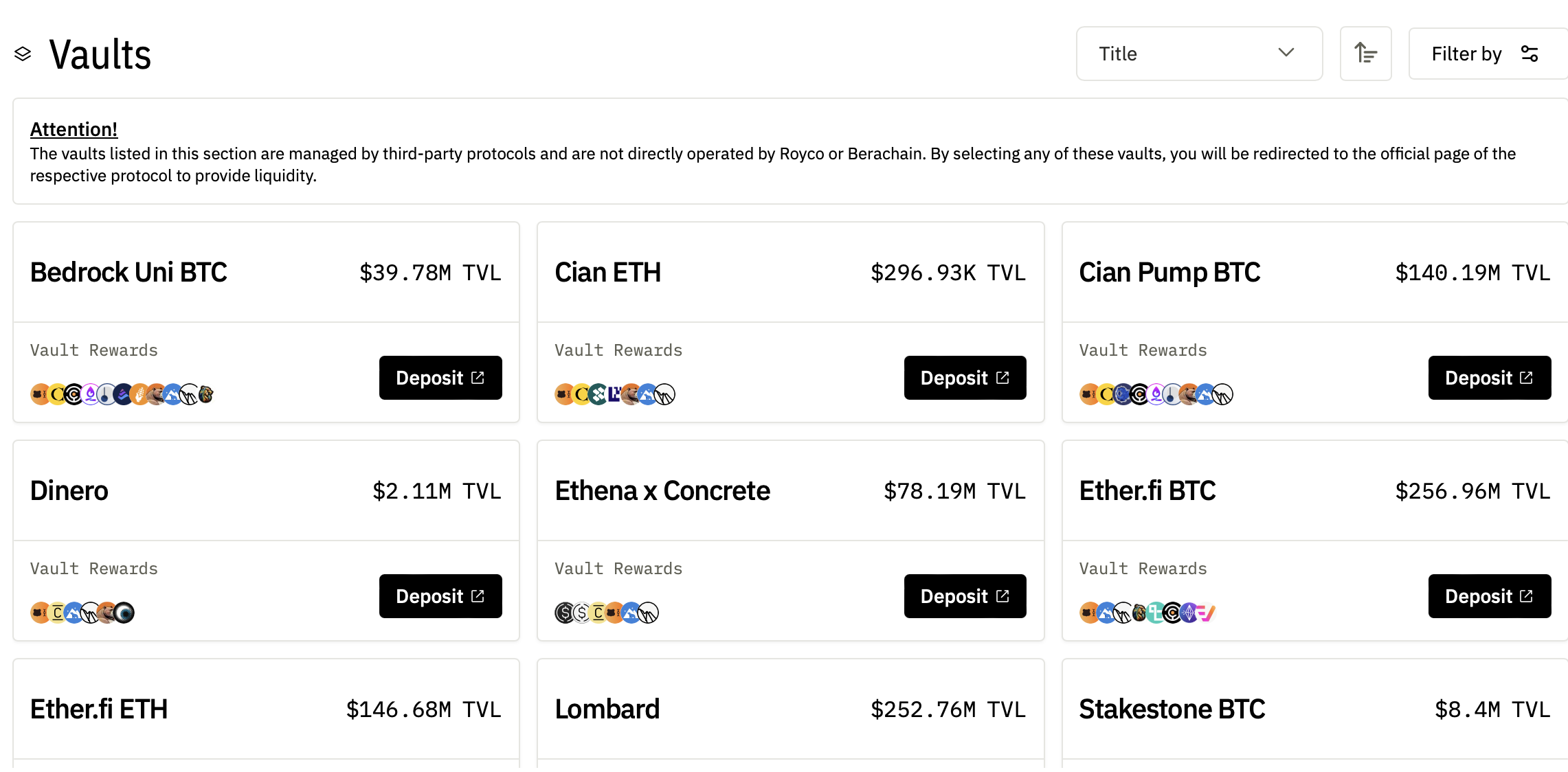

Berachain seems to be launching soon and in preparation, the Boyco vaults are doing quite well. Boyco is the Berachain version of Royco, an airdrop incentive project that lets projects create incentivized vaults, or actions for users to perform.

As a user you can think of it as a farming protocol, but the actions and conditions are a bit more nuanced than a typical vault. And in some cases you can even negotiate for more rewards. Very interesting take on airdrops/farms that makes them much more easily visible and accessible.

That's pretty much it for the major interesting updates this week.

Don't forget to subscribe if you haven't already to stay up to date.

For the video of this newsletter check out our Youtube.